Long before I was a management consultant or worked in software, I was an adjuster for State Farm insurance. From the moment I entered the claims office, I was bombarded with requests for payment, statements, documentation, vendor and third-party carrier requests, all while trying to respond to screaming (or worse) crying phone calls from insureds. The barrage of everyday claim activities chained me to my desk. To understand the big picture view of a claim that only the outside world could provide, I leveraged investigation services. These services provided the objective proof I needed to determine liability, cut off medical benefits and detect insurance fraud. Our new Guidewire partner, Ethos brings the outside world of the claim to the adjuster and helps adjusters make better, more objective claim decisions.

Who?

Ethos is a full-service risk investigation company employing 500 investigators.

Relevant services include:

Manned and unmanned surveillance. Professional cameras and video equipment are used to record a claimant’s activities. This can be used to prove or disprove an injury claim.

Digital fraud investigation. Services include internet mining, social media and background checks. This information can be used to determine whether a claimant is working or whether stolen property is still in the possession of the claimant.

Special investigation fraud services. A highly trained unit performs witness canvasses, statements and field interviews, as well as scene investigations to detect fraud.

What is its value proposition?

Ethos has identified that 25% of the defects they identify within their system, and associated results of the case, are related to inaccurate data that was misinterpreted in an email or phone call with an adjuster. Adjusters are busy. They are multitasking. By pushing or pulling primary information directly from the Ethos case file directly into the ClaimCenter file, accuracy of data will be dramatically improved. The outcome will be more accurate results and better claim decisions.

On average, Ethos speaks to or emails an adjuster 10 times per case. Again, adjusters are busy. Getting them on the phone or getting them to answer emails in a timely fashion is a challenge. With Guidewire, Ethos will push case updates, files and media directly from their system into Guidewire. This will shrink the communication gap and get valuable case information into the hands of the adjuster in a shorter time period.

The opportunity?

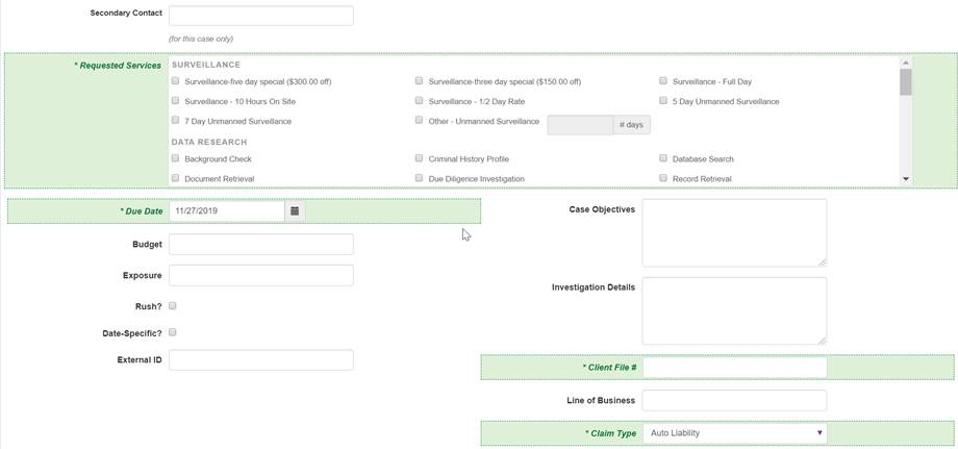

Ethos is building a DevConnect add-on that will enable Guidewire ClaimCenter users to integrate to Evestigate, Ethos’ software application for claims. The adjuster will initiate an Ethos service request on the claim file in ClaimCenter.

ClaimCenter will then auto-populate the Ethos service request with claim data.

Case statuses and information including images and reports will be accessible in ClaimCenter along with the associated invoice or request for payment.

Want more detail?

Watch this CTV news segment about the importance of surveillance to identify fraud and control claim costs.

To learn more about Ethos, please read the press release here. For more information on other insurtech solutions available for integration with Guidewire today, visit the Guidewire Marketplace at https://marketplace.guidewire.com/. You can also learn more by visiting our information on claims solutions.